根据隆基发布的报告,2016年上半年,实现营业收入64.24亿元,完成了全年收入目标的59%,同比增长282.51%;实现归属于母公司的净利润8.61亿元,同比增长634.17%。出货量方面,上半年隆基实现单晶硅片出货7.4亿片,完成了全年硅片出货目标的65%,其中对外销售5.75亿片,自用1.65亿片;上半年单晶组件出货922.85MW,完成了全年组件出货目标的40%,其中对外销售873.14MW,自用49.71MW。

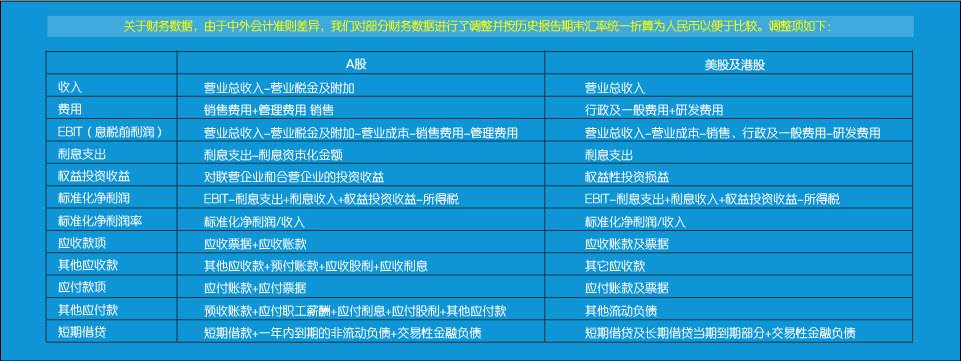

| 隆基股份利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 41.91 | 22.02 | 8.55 | 90.3% | 390.0% | 63.93 | 42.63 | 16.75 | 50.0% | 281.8% |

| 成本(亿人民币) | 30.86 | 16.75 | 6.85 | 84.2% | 350.7% | 47.61 | 34.07 | 13.29 | 39.7% | 258.3% |

| 毛利(亿人民币) | 11.05 | 5.27 | 1.71 | 109.6% | 547.3% | 16.32 | 8.56 | 3.46 | 90.7% | 372.1% |

| 毛利率 | 26.37% | 23.94% | 19.96% | 25.53% | 20.07% | 20.65% | ||||

| 费用(亿人民币) | 3.41 | 1.58 | 0.69 | 116.1% | 391.7% | 4.99 | 2.81 | 1.27 | 77.2% | 293.2% |

| 费用率 | 8.14% | 7.16% | 8.11% | 7.80% | 6.60% | 7.57% | ||||

| EBIT(亿人民币) | 7.64 | 3.69 | 1.01 | 106.8% | 653.7% | 11.33 | 5.74 | 2.19 | 97.4% | 417.8% |

| 净利润*(亿人民币) | 6.28 | 3.28 | 0.75 | 91.5% | 740.4% | 9.56 | 4.74 | 1.82 | 101.7% | 424.8% |

| 标准化净利润率 | 14.98% | 14.88% | 8.73% | 14.95% | 11.12% | 10.87% | ||||

| 归母净利润(亿人民币) | 5.94 | 2.66 | 0.43 | 123.2% | 1274.5% | 8.61 | 4.03 | 1.17 | 113.6% | 634.2% |

| SOLARZOOM 新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

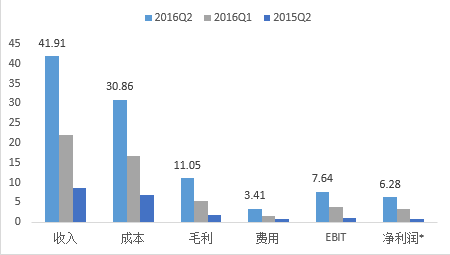

| 隆基股份资产负债表(调整) | |||||||

| 2016Q2 | 2016Q1 | 2015Q4 | 2015Q2 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 23.36 | 19.29 | 22.46 | 14.17 | 21.1% | 4.0% | 64.9% |

| 应收款项 | 33.43 | 21.60 | 20.81 | 8.10 | 54.8% | 60.6% | 312.8% |

| 存货 | 10.07 | 16.93 | 15.34 | 16.70 | -40.5% | -34.4% | -39.7% |

| 总资产 | 126.26 | 116.42 | 102.09 | 81.67 | 8.5% | 23.7% | 54.6% |

| 应付账款 | 24.84 | 22.55 | 21.26 | 12.02 | 10.1% | 16.8% | 106.6% |

| 短期借贷 | 2.91 | 2.46 | 6.48 | 7.60 | 18.5% | -55.0% | -61.7% |

| 长期借贷 | 13.81 | 14.43 | 1.98 | 0.37 | -4.2% | 597.7% | 3633.7% |

| 总负债 | 61.70 | 57.11 | 45.55 | 29.06 | 8.1% | 35.5% | 112.3% |

| 所有者权益 | 64.28 | 59.07 | 56.34 | 52.03 | 8.8% | 14.1% | 23.5% |

| 少数股东权益 | 0.27 | 0.25 | 0.19 | 0.59 | 11.5% | 40.8% | -53.2% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

报告期内,实现营业总收入363,466.51万元,较上年同期增长44.07%,经营性现金流量净额32,181.76万元,较上年同期增长171.39%,归属于上市公司股东的净利润25,082.99万元,较上年同期增长168.68%,报告期末归属于上市公司股东的净资产为1,045,047.41万元,较期初增长2.49%。

| 中环股份利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 20.37 | 15.96 | 13.91 | 27.6% | 46.5% | 36.33 | 25.14 | 25.22 | 44.5% | 44.1% |

| 成本(亿人民币) | 17.95 | 13.74 | 12.23 | 30.6% | 46.7% | 31.69 | 20.48 | 22.38 | 54.8% | 41.6% |

| 毛利(亿人民币) | 2.42 | 2.22 | 1.67 | 9.0% | 44.6% | 4.64 | 4.66 | 2.83 | -0.4% | 63.9% |

| 毛利率 | 11.89% | 13.92% | 12.04% | 12.78% | 18.55% | 11.23% | ||||

| 费用(亿人民币) | 1.01 | 1.06 | 0.95 | -5.3% | 6.4% | 2.07 | 2.10 | 1.67 | -1.7% | 23.6% |

| 费用率 | 4.94% | 6.66% | 6.80% | 5.70% | 8.37% | 6.64% | ||||

| EBIT(亿人民币) | 1.42 | 1.16 | 0.73 | 22.1% | 94.3% | 2.58 | 2.56 | 1.16 | 0.7% | 122.3% |

| 净利润*(亿人民币) | 0.73 | 1.00 | -0.09 | -26.8% | 923.6% | 1.73 | 0.53 | 0.15 | 224.6% | 1021.9% |

| 标准化净利润率 | 3.59% | 6.27% | -0.64% | 4.77% | 2.12% | 0.61% | ||||

| 归母净利润(亿人民币) | 1.47 | 1.03 | 0.59 | 42.7% | 148.5% | 2.51 | 1.09 | 0.93 | 130.7% | 168.7% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 中环股份资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 14.00 | 17.42 | 47.40 | 19.80 | -19.6% | -70.5% | -29.3% |

| 应收款项 | 12.48 | 15.72 | 12.20 | 10.79 | -20.6% | 2.3% | 15.6% |

| 存货 | 13.21 | 17.72 | 17.26 | 19.09 | -25.5% | -23.5% | -30.8% |

| 总资产 | 180.62 | 186.73 | 210.83 | 162.01 | -3.3% | -14.3% | 11.5% |

| 应付账款 | 12.12 | 20.39 | 22.61 | 19.46 | -40.6% | -46.4% | -37.7% |

| 短期借贷 | 36.34 | 36.18 | 40.94 | 32.79 | 0.4% | -11.2% | 10.8% |

| 长期借贷 | 24.59 | 22.18 | 39.63 | 37.83 | 10.8% | -38.0% | -35.0% |

| 总负债 | 75.09 | 82.58 | 107.72 | 94.23 | -9.1% | -30.3% | -20.3% |

| 归属母公司所有者权益 | 104.50 | 103.04 | 101.97 | 66.30 | 1.4% | 2.5% | 57.6% |

| 少数股东权益 | 1.03 | 1.10 | 1.14 | 1.48 | -6.8% | -10.2% | -30.4% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

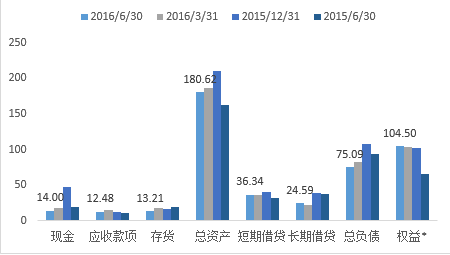

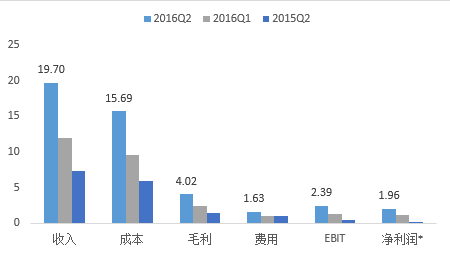

根据大全新能源公告,二季度公司多晶硅产量3570吨,相比一季度3405吨增长4.8%。二季度多晶硅外销量2931吨,相比一季度2905吨增长0.9%。二季度多晶硅平均总生产成本9.43美元,相比一季度9.65美元有一定下降。二季度硅片产量2500万片,相比一季度2210万片增长13.1%。财务方面,二季度收入7100万美元,相比一季度5770万美元增长23.1%。二季度非GAAP毛利率43.9%,一季度非GAAP毛利率为32.6%。

| 大全新能源利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 4.81 | 3.73 | 2.09 | 29.0% | 130.4% | 8.53 | 7.16 | 4.66 | 19.2% | 83.2% |

| 成本(亿人民币) | 2.83 | 2.65 | 1.87 | 7.0% | 51.4% | 5.48 | 5.46 | 3.92 | 0.3% | 39.6% |

| 毛利(亿人民币) | 1.98 | 1.08 | 0.22 | 82.8% | 810.5% | 3.06 | 1.70 | 0.74 | 79.8% | 314.8% |

| 毛利率 | 41.12% | 29.02% | 10.40% | 35.83% | 23.75% | 15.83% | ||||

| 费用(亿人民币) | 0.26 | 0.27 | 0.18 | -2.6% | 41.7% | 0.53 | 0.41 | 0.47 | 29.8% | 12.0% |

| 费用率 | 5.42% | 7.18% | 8.81% | 6.19% | 5.68% | 10.12% | ||||

| EBIT(亿人民币) | 1.72 | 0.81 | 0.03 | 110.9% | 5067.0% | 2.53 | 1.29 | 0.27 | 95.5% | 852.4% |

| 净利润*(亿人民币) | 1.30 | 0.50 | -0.11 | 162.6% | 1306.1% | 1.80 | 0.75 | -0.08 | 141.1% | 2264.1% |

| 标准化净利润率 | 27.09% | 13.31% | -5.17% | 21.07% | 10.41% | -1.78% | ||||

| 归母净利润(亿人民币) | 1.33 | 0.54 | -0.06 | 147.3% | 2435.5% | 1.87 | 0.83 | 0.02 | 126.2% | 12024.6% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

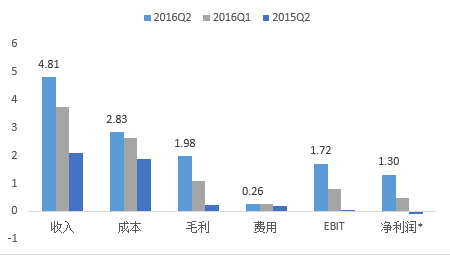

| 大全新能源资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 1.97 | 1.06 | 0.94 | 3.58 | 86.2% | 109.0% | -45.1% |

| 应收款项 | 1.65 | 2.63 | 2.01 | 2.77 | -37.3% | -18.0% | -40.5% |

| 存货 | 0.63 | 0.70 | 1.09 | 0.64 | -9.9% | -41.9% | -1.6% |

| 总资产 | 43.94 | 43.45 | 42.91 | 47.57 | 1.1% | 2.4% | -7.6% |

| 应付账款 | 2.97 | 3.00 | 2.44 | 3.78 | -1.1% | 21.4% | -21.5% |

| 短期借贷 | 7.26 | 8.17 | 8.05 | 10.15 | -11.1% | -9.8% | -28.5% |

| 长期借贷 | 7.85 | 7.42 | 7.70 | 6.11 | 5.8% | 2.0% | 28.4% |

| 总负债 | 26.30 | 27.07 | 27.22 | 33.05 | -2.8% | -3.4% | -20.4% |

| 归属母公司所有者权益 | 17.55 | 16.29 | 15.61 | 14.52 | 7.7% | 12.4% | 20.8% |

| 少数股东权益 | 0.10 | 0.09 | 0.08 | 0.00 | 12.4% | 18.4% | |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

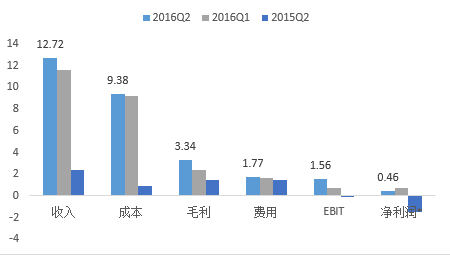

根据海润光伏发布的半年报,报告期内,公司实现营业收入245,099.68万元,同比增长29.21%,归属于上市公司股东的净利润4,246.44万元。营收占比较大的为组件和电池片业务,分别占营收的50.7%和14.92%,毛利率分别为23.53%和17.49%。

| 海润光伏利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 12.72 | 11.56 | 2.40 | 10.0% | 429.2% | 24.28 | 41.66 | 18.91 | -41.7% | 28.4% |

| 成本(亿人民币) | 9.38 | 9.16 | 0.94 | 2.4% | 900.9% | 18.55 | 34.04 | 15.41 | -45.5% | 20.4% |

| 毛利(亿人民币) | 3.34 | 2.40 | 1.47 | 39.3% | 127.7% | 5.73 | 7.62 | 3.51 | -24.8% | 63.5% |

| 毛利率 | 26.24% | 20.73% | 61.00% | 23.62% | 18.30% | 18.55% | ||||

| 费用(亿人民币) | 1.77 | 1.67 | 1.50 | 6.4% | 18.0% | 3.44 | 5.01 | 2.98 | -31.2% | 15.5% |

| 费用率 | 13.95% | 14.42% | 62.58% | 14.17% | 12.01% | 15.76% | ||||

| EBIT(亿人民币) | 1.56 | 0.73 | -0.04 | 114.4% | 4213.9% | 2.29 | 2.62 | 0.53 | -12.4% | 334.2% |

| 净利润*(亿人民币) | 0.46 | 0.77 | -1.50 | -40.4% | 130.8% | 1.24 | 1.76 | -0.97 | -29.7% | 227.2% |

| 标准化净利润率 | 3.63% | 6.70% | -62.35% | 5.09% | 4.22% | -5.14% | ||||

| 归母净利润(亿人民币) | 0.30 | 0.13 | 0.12 | 139.6% | 148.4% | 0.42 | 0.60 | 0.36 | -29.6% | 18.7% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 海润光伏资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

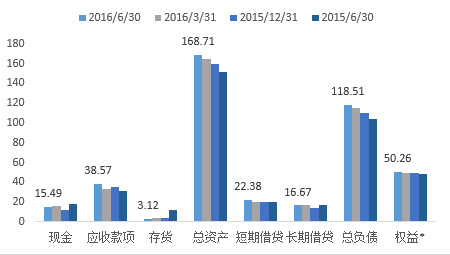

| 现金 | 15.49 | 16.09 | 11.81 | 18.36 | -3.7% | 31.2% | -15.6% |

| 应收款项 | 38.57 | 33.28 | 35.04 | 30.77 | 15.9% | 10.1% | 25.4% |

| 存货 | 3.12 | 4.33 | 3.62 | 11.76 | -27.9% | -13.7% | -73.4% |

| 总资产 | 168.71 | 165.02 | 159.27 | 151.83 | 2.2% | 5.9% | 11.1% |

| 应付账款 | 41.25 | 37.75 | 40.10 | 44.14 | 9.3% | 2.9% | -6.6% |

| 短期借贷 | 22.38 | 20.16 | 19.80 | 20.53 | 11.0% | 13.0% | 9.0% |

| 长期借贷 | 16.67 | 17.02 | 13.75 | 17.00 | -2.0% | 21.3% | -1.9% |

| 总负债 | 118.51 | 115.27 | 109.93 | 103.61 | 2.8% | 7.8% | 14.4% |

| 归属母公司所有者权益 | 50.26 | 49.81 | 49.39 | 48.25 | 0.9% | 1.8% | 4.2% |

| 少数股东权益 | -0.06 | -0.05 | -0.05 | -0.04 | -21.8% | -19.7% | -72.0% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

根据阿特斯发布的二季度财报,二季度公司实现收入8.059亿美元,环比增长11.7%,同比增长26.6%。组件确认收入的出货量达1290MW,一季度确认收入的组件出货量1172MW。二季度毛利率17.2%,相比一季度15.2%有所增长。二季度实现净利润4040万美元,相比一季度2260万美元增长78.76%,增长明显。

| 阿特斯太阳能利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 54.67 | 46.61 | 38.68 | 17.3% | 41.3% | 101.28 | 133.62 | 91.55 | -24.2% | 10.6% |

| 成本(亿人民币) | 45.29 | 39.35 | 32.82 | 15.1% | 38.0% | 84.64 | 111.42 | 76.30 | -24.0% | 10.9% |

| 毛利(亿人民币) | 9.37 | 7.27 | 5.86 | 29.0% | 60.0% | 16.64 | 22.20 | 15.25 | -25.0% | 9.1% |

| 毛利率 | 17.15% | 15.59% | 15.15% | 16.43% | 16.61% | 16.66% | ||||

| 费用(亿人民币) | 6.68 | 4.79 | 3.89 | 39.6% | 71.6% | 11.47 | 12.94 | 8.45 | -11.3% | 35.7% |

| 费用率 | 12.23% | 10.27% | 10.07% | 11.33% | 9.68% | 9.23% | ||||

| EBIT(亿人民币) | 2.69 | 2.48 | 1.96 | 8.5% | 37.0% | 5.17 | 9.26 | 6.80 | -44.2% | -24.0% |

| 净利润*(亿人民币) | 1.02 | 0.69 | 1.29 | 49.1% | -21.0% | 1.71 | 5.88 | 4.50 | -71.0% | -62.0% |

| 标准化净利润率 | 1.87% | 1.47% | 3.35% | 1.69% | 4.40% | 4.92% | ||||

| 归母净利润(亿人民币) | 2.72 | 1.46 | 1.07 | 86.1% | 152.8% | 4.18 | 6.32 | 4.84 | -33.9% | -13.8% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 阿特斯太阳能资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 32.83 | 26.64 | 35.91 | 24.66 | 23.2% | -8.6% | 33.1% |

| 应收款项 | 24.08 | 26.01 | 28.25 | 21.76 | -7.4% | -14.8% | 10.6% |

| 存货 | 20.54 | 26.70 | 21.72 | 31.86 | -23.1% | -5.5% | -35.5% |

| 总资产 | 327.69 | 310.20 | 286.84 | 226.91 | 5.6% | 14.2% | 44.4% |

| 应付账款 | 62.15 | 62.11 | 64.01 | 59.51 | 0.1% | -2.9% | 4.4% |

| 短期借贷 | 93.17 | 88.60 | 77.39 | 57.67 | 5.2% | 20.4% | 61.6% |

| 长期借贷 | 68.63 | 61.43 | 49.13 | 30.77 | 11.7% | 39.7% | 123.1% |

| 总负债 | 266.00 | 251.55 | 232.78 | 178.21 | 5.7% | 14.3% | 49.3% |

| 归属母公司所有者权益 | 60.77 | 57.53 | 53.18 | 47.86 | 5.6% | 14.3% | 27.0% |

| 少数股东权益 | 0.92 | 1.12 | 0.88 | 0.84 | -17.6% | 4.6% | 9.9% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

晶澳二季度实现收入41亿人民币(6.19亿美元),同比增长51.9%,环比增长18.6%。二季度毛利润15.3%,同比增长1.1个百分点,环比下降1.3个百分点。出货方面,二季度晶澳组件出货量1134.2MW,同比增长58.1%,环比增长23.4%。

| 晶澳太阳能利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 41.14 | 34.70 | 27.08 | 18.6% | 51.9% | 75.83 | 84.14 | 51.11 | -9.9% | 48.4% |

| 成本(亿人民币) | 34.85 | 28.94 | 22.64 | 20.4% | 54.0% | 63.80 | 69.52 | 42.80 | -8.2% | 49.0% |

| 毛利(亿人民币) | 6.28 | 5.75 | 4.44 | 9.2% | 41.4% | 12.04 | 14.62 | 8.31 | -17.7% | 44.9% |

| 毛利率 | 15.27% | 16.58% | 16.40% | 15.87% | 17.37% | 16.26% | ||||

| 费用(亿人民币) | 4.40 | 3.52 | 2.88 | 25.1% | 52.8% | 7.92 | 8.70 | 5.25 | -8.9% | 50.9% |

| 费用率 | 10.70% | 10.15% | 10.64% | 10.45% | 10.34% | 10.27% | ||||

| EBIT(亿人民币) | 1.88 | 2.23 | 1.56 | -15.8% | 20.4% | 4.11 | 5.92 | 3.06 | -30.5% | 34.5% |

| 净利润*(亿人民币) | 0.86 | 1.18 | 0.71 | -27.4% | 21.6% | 2.04 | 3.81 | 1.41 | -46.5% | 44.4% |

| 标准化净利润率 | 2.09% | 3.41% | 2.60% | 2.69% | 4.53% | 2.76% | ||||

| 归母净利润(亿人民币) | 1.64 | 1.57 | 1.35 | 4.5% | 20.8% | 3.20 | 4.53 | 1.71 | -29.2% | 87.3% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 晶澳太阳能资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 20.14 | 23.35 | 28.83 | 17.49 | -13.7% | -30.2% | 15.2% |

| 应收款项 | 33.14 | 30.64 | 37.10 | 26.93 | 8.2% | -10.7% | 23.0% |

| 存货 | 32.57 | 27.23 | 16.61 | 22.52 | 19.6% | 96.1% | 44.6% |

| 总资产 | 194.67 | 175.28 | 163.06 | 143.38 | 11.1% | 19.4% | 35.8% |

| 应付账款 | 35.53 | 29.82 | 23.89 | 23.73 | 19.1% | 48.7% | 49.7% |

| 短期借贷 | 34.66 | 28.13 | 25.05 | 21.18 | 23.2% | 38.4% | 63.6% |

| 长期借贷 | 26.21 | 26.41 | 24.61 | 23.49 | -0.8% | 6.5% | 11.6% |

| 总负债 | 132.49 | 114.53 | 103.89 | 86.92 | 15.7% | 27.5% | 52.4% |

| 归属母公司所有者权益 | 61.19 | 59.77 | 58.20 | 55.40 | 2.4% | 5.1% | 10.4% |

| 少数股东权益 | 0.99 | 0.99 | 0.97 | 1.07 | 0.4% | 2.0% | -6.9% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

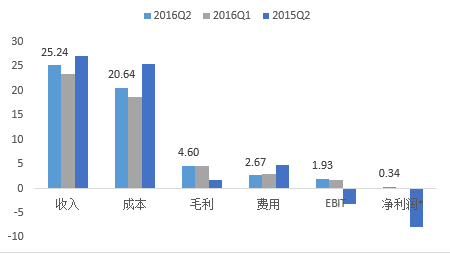

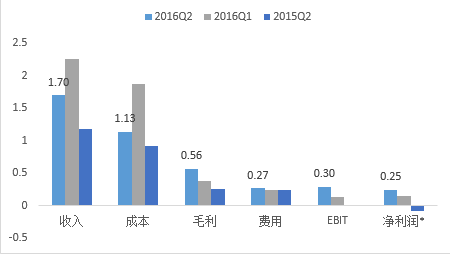

根据英利发布的二季度财报,二季度公司实现收入25.24亿元人民币(3.798亿美元),同比下降7.1%,环比增长7.4%。二季度组件出货量662MW,相比一季度508.1MW的出货量有所增加。二季度毛利润和毛利率分别为4.6亿人民币和18.2。一季度毛利润和毛利率分别为4.69亿元人民币和20%。GAAP下净利润7180万人民币,调整后的非GAAP净利润1068万美元。

| 英利绿色能源利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 25.24 | 23.51 | 27.16 | 7.4% | -7.1% | 48.75 | 43.44 | 56.22 | 12.2% | -13.3% |

| 成本(亿人民币) | 20.64 | 18.82 | 25.45 | 9.7% | -18.9% | 39.46 | 37.38 | 50.40 | 5.5% | -21.7% |

| 毛利(亿人民币) | 4.60 | 4.69 | 1.71 | -2.0% | 169.1% | 9.29 | 6.05 | 5.82 | 53.5% | 59.7% |

| 毛利率 | 18.23% | 19.96% | 6.30% | 19.06% | 13.94% | 10.35% | ||||

| 费用(亿人民币) | 2.67 | 2.89 | 4.88 | -7.7% | -45.2% | 5.57 | 8.09 | 9.65 | -31.2% | -42.3% |

| 费用率 | 10.59% | 12.31% | 17.96% | 11.42% | 18.63% | 17.17% | ||||

| EBIT(亿人民币) | 1.93 | 1.80 | -3.17 | 7.2% | 160.9% | 3.73 | -2.04 | -3.83 | 282.7% | 197.3% |

| 净利润*(亿人民币) | 0.34 | -0.09 | -7.85 | 473.8% | 104.4% | 0.25 | -11.91 | -10.82 | 102.1% | 102.3% |

| 标准化净利润率 | 1.36% | -0.39% | -28.91% | 0.51% | -27.42% | -19.25% | ||||

| 归母净利润(亿人民币) | 0.72 | 0.80 | -5.98 | -9.7% | 112.0% | 1.51 | -46.39 | -9.61 | 103.3% | 115.7% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 英利绿色能源资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

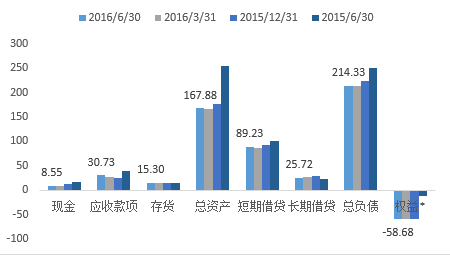

| 现金 | 8.55 | 8.91 | 12.41 | 17.77 | -4.1% | -31.1% | -51.9% |

| 应收款项 | 30.73 | 27.28 | 24.75 | 38.54 | 12.7% | 24.2% | -20.3% |

| 存货 | 15.30 | 14.16 | 14.84 | 15.22 | 8.1% | 3.1% | 0.5% |

| 总资产 | 167.88 | 167.33 | 176.40 | 254.17 | 0.3% | -4.8% | -34.0% |

| 应付账款 | 31.12 | 34.67 | 39.60 | 54.32 | -10.2% | -21.4% | -42.7% |

| 短期借贷 | 89.23 | 87.11 | 91.99 | 100.78 | 2.4% | -3.0% | -11.5% |

| 长期借贷 | 25.72 | 26.50 | 29.62 | 23.64 | -2.9% | -13.2% | 8.8% |

| 总负债 | 214.33 | 213.83 | 223.52 | 251.10 | 0.2% | -4.1% | -14.6% |

| 归属母公司所有者权益 | -58.68 | -58.62 | -59.40 | -11.52 | -0.1% | 1.2% | -409.2% |

| 少数股东权益 | 12.23 | 12.12 | 12.28 | 14.59 | 0.9% | -0.4% | -16.2% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

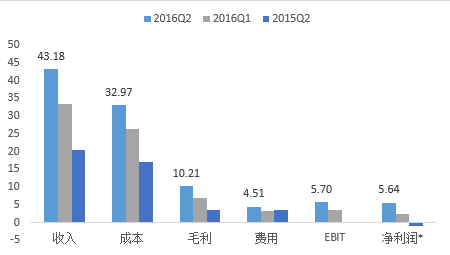

韩华二季度实现收入6.38亿美元,相比一季度5.149亿美元增长23.9%。相比2015Q2收入3.38亿美元同比增长88.76%。二季度实现净利润1.512亿美元,一季度为1.09亿美元。二季度毛利率23.7%,相比2016年一季度21.2%和2015年二季度17.3%的毛利率均有所增长。

| 韩华新能源利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 43.18 | 33.27 | 20.57 | 29.8% | 109.9% | 76.45 | 75.88 | 41.05 | 0.7% | 86.2% |

| 成本(亿人民币) | 32.97 | 26.23 | 17.01 | 25.7% | 93.8% | 59.20 | 60.72 | 34.52 | -2.5% | 71.5% |

| 毛利(亿人民币) | 10.21 | 7.04 | 3.56 | 45.0% | 187.1% | 17.25 | 15.16 | 6.53 | 13.8% | 164.3% |

| 毛利率 | 23.65% | 21.17% | 17.29% | 22.57% | 19.98% | 15.90% | ||||

| 费用(亿人民币) | 4.51 | 3.38 | 3.50 | 33.5% | 29.0% | 7.89 | 9.03 | 6.17 | -12.6% | 27.8% |

| 费用率 | 10.45% | 10.16% | 17.00% | 10.32% | 11.90% | 15.04% | ||||

| EBIT(亿人民币) | 5.70 | 3.66 | 0.06 | 55.6% | 9437.2% | 9.36 | 6.13 | 0.35 | 52.7% | 2540.6% |

| 净利润*(亿人民币) | 5.64 | 2.54 | -0.89 | 122.0% | 733.2% | 8.18 | 3.56 | -1.41 | 129.5% | 681.5% |

| 标准化净利润率 | 13.05% | 7.63% | -4.33% | 10.69% | 4.69% | -3.43% | ||||

| 归母净利润(亿人民币) | 5.14 | 1.78 | -0.86 | 189.3% | 696.0% | 6.92 | 4.96 | -2.12 | 39.5% | 427.0% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 韩华新能源资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 16.94 | 21.15 | 12.99 | 29.09 | -19.9% | 30.4% | -41.8% |

| 应收款项 | 20.98 | 20.41 | 23.71 | 18.62 | 2.8% | -11.5% | 12.7% |

| 存货 | 32.18 | 29.97 | 26.37 | 27.18 | 7.4% | 22.0% | 18.4% |

| 总资产 | 171.49 | 166.16 | 165.42 | 167.67 | 3.2% | 3.7% | 2.3% |

| 应付账款 | 20.35 | 22.36 | 23.06 | 23.79 | -9.0% | -11.7% | -14.5% |

| 短期借贷 | 26.60 | 29.91 | 27.11 | 28.17 | -11.0% | -1.9% | -5.6% |

| 长期借贷 | 53.02 | 41.87 | 42.44 | 37.86 | 26.6% | 24.9% | 40.1% |

| 总负债 | 142.47 | 140.96 | 143.33 | 151.34 | 1.1% | -0.6% | -5.9% |

| 归属母公司所有者权益 | 29.02 | 25.21 | 22.09 | 16.33 | 15.1% | 31.4% | 77.7% |

| 少数股东权益 | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

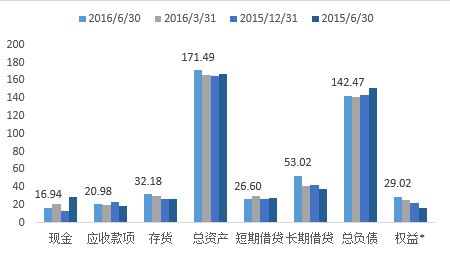

报告期内,公司实现营业收入 319,260.94 万元,较上年同期增长124.81%;营业利润31,387.59万元,较上年同期增长1,340.04%;归属于上市公司股东的净利润27,826.01万元,较上年同期增长736.42%。报告期内,公司国内组件销售量为841MW,同比增长186.05%。国外市场方面,由于受部分国家贸易保护政策、经济低迷等多重不利因素影响,传统欧洲市场持续低迷,新兴市场出货量暂未有重大突破。

| 亿晶光电利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 19.70 | 12.00 | 7.38 | 64.2% | 166.9% | 31.70 | 34.89 | 14.16 | -9.1% | 123.9% |

| 成本(亿人民币) | 15.69 | 9.59 | 5.97 | 63.5% | 162.6% | 25.28 | 27.82 | 11.73 | -9.1% | 115.5% |

| 毛利(亿人民币) | 4.02 | 2.41 | 1.41 | 67.0% | 185.5% | 6.42 | 7.07 | 2.43 | -9.2% | 164.6% |

| 毛利率 | 20.39% | 20.04% | 19.07% | 20.26% | 20.26% | 17.14% | ||||

| 费用(亿人民币) | 1.63 | 1.06 | 1.00 | 54.0% | 62.3% | 2.68 | 2.95 | 1.78 | -8.9% | 50.6% |

| 费用率 | 8.26% | 8.80% | 13.58% | 8.46% | 8.44% | 12.59% | ||||

| EBIT(亿人民币) | 2.39 | 1.35 | 0.40 | 77.2% | 490.3% | 3.74 | 4.12 | 0.65 | -9.3% | 479.5% |

| 净利润*(亿人民币) | 1.96 | 1.20 | 0.01 | 63.5% | 16362.3% | 3.16 | 3.84 | 0.29 | -17.6% | 1000.4% |

| 标准化净利润率 | 9.96% | 10.00% | 0.16% | 9.97% | 10.99% | 2.03% | ||||

| 归母净利润(亿人民币) | 1.85 | 0.93 | 0.22 | 97.8% | 746.2% | 2.78 | 2.00 | 0.33 | 39.0% | 736.4% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 亿晶光电资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 12.23 | 12.57 | 12.61 | 5.26 | -2.7% | -3.1% | 132.6% |

| 应收款项 | 12.38 | 12.22 | 11.99 | 10.74 | 1.3% | 3.2% | 15.2% |

| 存货 | 5.34 | 8.23 | 6.71 | 11.94 | -35.1% | -20.4% | -55.2% |

| 总资产 | 66.76 | 68.13 | 67.25 | 68.68 | -2.0% | -0.7% | -2.8% |

| 应付账款 | 17.67 | 18.10 | 18.22 | 20.80 | -2.4% | -3.0% | -15.1% |

| 短期借贷 | 0.00 | 11.55 | 12.92 | 14.19 | -100.0% | -100.0% | -100.0% |

| 长期借贷 | 2.00 | 0.00 | 0.00 | 0.00 | |||

| 总负债 | 37.24 | 39.69 | 39.74 | 43.06 | -6.2% | -6.3% | -13.5% |

| 归属母公司所有者权益 | 29.52 | 28.44 | 27.51 | 25.49 | 3.8% | 7.3% | 15.8% |

| 少数股东权益 | 0.00 | 0.00 | 0.00 | 0.13 | -100.0% | ||

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

根据天合发布的二季度财报,二季度天合组件总出货量1658.3MW,含1619MW对外出货和39.3下游电站使用。2016年一季度总出货量为1423.3,2015年二季度组件总出货量1231.6MW。财务方面,二季度天合实现收入9.616亿美元,相比一季度8.169亿美元和2015年二季度7.229亿美元均有所增长。二季度毛利润和毛利率分别为1.763亿美元和18.3%。

| 天合光能利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 65.16 | 52.78 | 44.04 | 23.4% | 48.0% | 117.94 | 118.80 | 78.32 | -0.7% | 50.6% |

| 成本(亿人民币) | 53.23 | 43.76 | 35.21 | 21.6% | 51.2% | 96.98 | 96.99 | 63.33 | 0.0% | 53.1% |

| 毛利(亿人民币) | 11.93 | 9.03 | 8.83 | 32.2% | 35.1% | 20.96 | 21.81 | 14.99 | -3.9% | 39.8% |

| 毛利率 | 18.31% | 17.10% | 20.05% | 17.77% | 18.36% | 19.14% | ||||

| 费用(亿人民币) | 6.78 | 6.34 | 5.13 | 6.9% | 32.3% | 13.12 | 12.88 | 9.50 | 1.9% | 38.2% |

| 费用率 | 10.40% | 12.02% | 11.64% | 11.13% | 10.85% | 12.13% | ||||

| EBIT(亿人民币) | 5.15 | 2.68 | 3.70 | 92.1% | 39.2% | 7.83 | 8.92 | 5.49 | -12.2% | 42.6% |

| 净利润*(亿人民币) | 2.33 | 1.47 | 2.23 | 58.6% | 4.6% | 3.80 | 6.24 | 3.17 | -39.1% | 20.2% |

| 标准化净利润率 | 3.58% | 2.79% | 5.07% | 3.23% | 5.26% | 4.04% | ||||

| 归母净利润(亿人民币) | 2.72 | 1.72 | 2.50 | 57.9% | 8.8% | 4.44 | 1.62 | 3.35 | 174.3% | 32.3% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 天合光能资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 42.98 | 29.23 | 30.22 | 27.91 | 47.0% | 42.2% | 54.0% |

| 应收款项 | 43.45 | 36.99 | 42.78 | 38.72 | 17.5% | 1.6% | 12.2% |

| 存货 | 33.79 | 37.10 | 28.05 | 21.51 | -8.9% | 20.4% | 57.1% |

| 总资产 | 337.74 | 311.21 | 304.81 | 219.58 | 8.5% | 10.8% | 53.8% |

| 应付账款 | 81.37 | 82.70 | 90.27 | 48.97 | -1.6% | -9.9% | 66.2% |

| 短期借贷 | 88.10 | 60.30 | 60.40 | 56.50 | 46.1% | 45.8% | 55.9% |

| 长期借贷 | 49.53 | 55.90 | 53.97 | 23.37 | -11.4% | -8.2% | 111.9% |

| 总负债 | 260.99 | 238.58 | 233.99 | 154.50 | 9.4% | 11.5% | 68.9% |

| 归属母公司所有者权益 | 73.86 | 69.91 | 68.23 | 63.07 | 5.7% | 8.2% | 17.1% |

| 少数股东权益 | 2.89 | 2.72 | 2.59 | 2.01 | 6.3% | 11.8% | 44.1% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

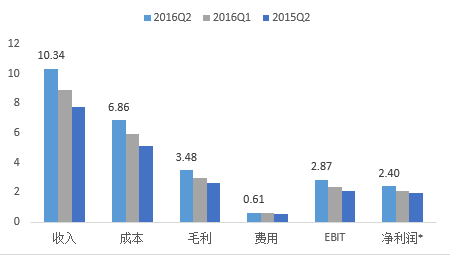

报告期内,公司实现营业收入193,525.95万元,较上年同期增长27.46%;归属于上市公司股东的净利润44,186.01万元,较上年同期增长63.97%。光伏封装材料方面,公司上半年实现营业收入193,525.95万元,较上年同期增长27.46%,其中EVA胶膜销售显著增长,实现营业收入173,940.40万元,较上年同期增长27.49%;背板销售基本保持平稳,营业收入13,060.84万元。

| 福斯特利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 10.34 | 8.90 | 7.75 | 16.2% | 33.4% | 19.24 | 18.06 | 15.10 | 6.5% | 27.4% |

| 成本(亿人民币) | 6.86 | 5.92 | 5.12 | 15.9% | 33.9% | 12.77 | 12.20 | 10.18 | 4.7% | 25.4% |

| 毛利(亿人民币) | 3.48 | 2.98 | 2.63 | 16.7% | 32.4% | 6.47 | 5.86 | 4.92 | 10.4% | 31.4% |

| 毛利率 | 33.68% | 33.52% | 33.93% | 33.61% | 32.44% | 32.57% | ||||

| 费用(亿人民币) | 0.61 | 0.63 | 0.52 | -2.3% | 18.1% | 1.24 | 1.53 | 0.96 | -19.0% | 29.0% |

| 费用率 | 5.93% | 7.06% | 6.71% | 6.45% | 8.49% | 6.37% | ||||

| EBIT(亿人民币) | 2.87 | 2.36 | 2.11 | 21.8% | 36.0% | 5.22 | 4.32 | 3.96 | 20.8% | 32.0% |

| 净利润*(亿人民币) | 2.40 | 2.10 | 1.93 | 14.3% | 24.6% | 4.50 | 3.61 | 3.62 | 24.9% | 24.5% |

| 标准化净利润率 | 23.24% | 23.62% | 24.89% | 23.42% | 19.98% | 23.95% | ||||

| 归母净利润(亿人民币) | 2.82 | 1.60 | 1.61 | 76.6% | 75.1% | 4.42 | 3.78 | 2.69 | 17.0% | 64.0% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 福斯特资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 6.18 | 11.84 | 6.70 | 3.23 | -47.8% | -7.8% | 91.1% |

| 应收款项 | 18.75 | 16.70 | 16.14 | 13.96 | 12.2% | 16.2% | 34.3% |

| 存货 | 4.93 | 4.66 | 4.38 | 4.07 | 5.7% | 12.4% | 21.0% |

| 总资产 | 51.03 | 49.29 | 48.35 | 43.38 | 3.5% | 5.5% | 17.6% |

| 应付账款 | 5.27 | 3.69 | 4.30 | 3.31 | 43.0% | 22.7% | 59.4% |

| 短期借贷 | 0.00 | 0.01 | 0.00 | 0.00 | -100.0% | ||

| 长期借贷 | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 总负债 | 6.71 | 5.01 | 5.66 | 4.47 | 33.9% | 18.4% | 50.0% |

| 归属母公司所有者权益 | 44.32 | 44.28 | 42.69 | 38.91 | 0.1% | 3.8% | 13.9% |

| 少数股东权益 | 0.00 | 0.00 | 0.00 | 0.00 | -105.5% | -879.4% | |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

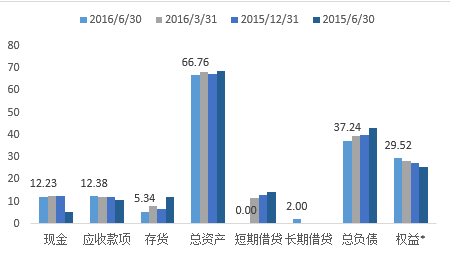

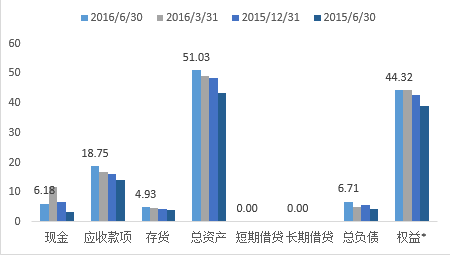

2016年上半年,公司合并实现销售收入39697.95万元(不含税),比去年同期增长85.01%,实现归属于上市公司股东的净利润2970.82万元,比去年同期增长525.96%,较好地完成了半年度经营目标。太阳能光伏装备方面,公司实现收入21480万元,毛利率33.35%。

| 精功科技利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 1.70 | 2.25 | 1.18 | -24.7% | 43.5% | 3.95 | 4.32 | 2.13 | -8.4% | 85.2% |

| 成本(亿人民币) | 1.13 | 1.88 | 0.92 | -39.6% | 23.1% | 3.01 | 3.12 | 1.70 | -3.6% | 76.6% |

| 毛利(亿人民币) | 0.56 | 0.38 | 0.26 | 49.5% | 114.7% | 0.94 | 1.19 | 0.43 | -21.1% | 119.2% |

| 毛利率 | 33.23% | 16.73% | 22.21% | 23.82% | 27.64% | 20.12% | ||||

| 费用(亿人民币) | 0.27 | 0.24 | 0.25 | 11.0% | 8.7% | 0.51 | 0.58 | 0.47 | -11.2% | 8.5% |

| 费用率 | 15.84% | 10.74% | 20.90% | 12.93% | 13.34% | 22.07% | ||||

| EBIT(亿人民币) | 0.30 | 0.14 | 0.02 | 118.4% | 1810.3% | 0.43 | 0.62 | -0.04 | -30.3% | 1138.7% |

| 净利润*(亿人民币) | 0.25 | 0.15 | -0.07 | 67.5% | 429.4% | 0.39 | 0.55 | -0.14 | -29.0% | 388.7% |

| 标准化净利润率 | 14.49% | 6.51% | -6.31% | 9.94% | 12.81% | -6.37% | ||||

| 归母净利润(亿人民币) | 0.21 | 0.09 | 0.02 | 142.5% | 835.5% | 0.30 | 0.11 | 0.05 | 167.2% | 526.0% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 精功科技资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 2.73 | 2.55 | 3.67 | 2.81 | 7.4% | -25.6% | -2.7% |

| 应收款项 | 4.29 | 5.35 | 4.06 | 4.06 | -19.8% | 5.6% | 5.6% |

| 存货 | 1.80 | 1.72 | 2.25 | 2.93 | 4.2% | -20.3% | -38.7% |

| 总资产 | 14.78 | 15.89 | 15.62 | 15.81 | -7.0% | -5.3% | -6.5% |

| 应付账款 | 2.49 | 2.74 | 2.25 | 1.99 | -8.9% | 10.8% | 25.5% |

| 短期借贷 | 1.99 | 2.81 | 2.73 | 4.01 | -29.2% | -27.1% | -50.4% |

| 长期借贷 | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 总负债 | 5.72 | 7.03 | 6.85 | 7.14 | -18.7% | -16.4% | -19.9% |

| 归属母公司所有者权益 | 8.97 | 8.75 | 8.66 | 8.54 | 2.5% | 3.5% | 5.0% |

| 少数股东权益 | 0.09 | 0.10 | 0.11 | 0.13 | -7.1% | -13.4% | -27.0% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

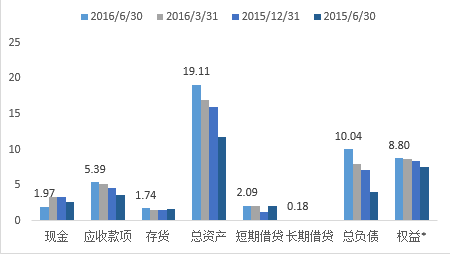

根据中来股份2016半年报,报告期内,公司实现营业收入607,218,816.74元,较上年同期增长150.72%;实现净利润80,611,281.65元,较上年同期增长81.69%。背膜业务方面,公司上半年实现营业收入602,260,336.09元,较上年同期增长156.45%,毛利率32.07%。

| 中来股份利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 3.40 | 2.64 | 1.17 | 28.8% | 191.5% | 6.04 | 4.89 | 2.41 | 23.4% | 150.3% |

| 成本(亿人民币) | 2.33 | 1.83 | 0.80 | 27.0% | 192.4% | 4.16 | 3.38 | 1.59 | 23.0% | 162.7% |

| 毛利(亿人民币) | 1.07 | 0.81 | 0.37 | 32.8% | 189.4% | 1.88 | 1.51 | 0.83 | 24.3% | 126.6% |

| 毛利率 | 31.49% | 30.54% | 31.71% | 31.07% | 30.85% | 34.33% | ||||

| 费用(亿人民币) | 0.40 | 0.26 | 0.18 | 53.3% | 120.3% | 0.66 | 0.48 | 0.31 | 36.8% | 115.0% |

| 费用率 | 11.76% | 9.88% | 15.56% | 10.94% | 9.87% | 12.73% | ||||

| EBIT(亿人民币) | 0.67 | 0.55 | 0.19 | 22.9% | 256.1% | 1.22 | 1.03 | 0.52 | 18.4% | 133.3% |

| 净利润*(亿人民币) | 0.48 | 0.43 | 0.14 | 11.8% | 239.1% | 0.90 | 0.73 | 0.42 | 24.4% | 114.0% |

| 标准化净利润率 | 14.02% | 16.16% | 12.05% | 14.96% | 14.83% | 17.49% | ||||

| 归母净利润(亿人民币) | 0.45 | 0.36 | 0.17 | 22.9% | 162.3% | 0.81 | 0.63 | 0.44 | 28.1% | 82.9% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 中来股份资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 1.97 | 3.34 | 3.37 | 2.67 | -41.1% | -41.6% | -26.2% |

| 应收款项 | 5.39 | 5.15 | 4.64 | 3.57 | 4.7% | 16.2% | 51.1% |

| 存货 | 1.74 | 1.57 | 1.48 | 1.71 | 10.5% | 17.6% | 1.9% |

| 总资产 | 19.11 | 17.03 | 15.98 | 11.72 | 12.3% | 19.6% | 63.1% |

| 应付账款 | 4.86 | 3.50 | 3.59 | 1.91 | 38.7% | 35.1% | 153.8% |

| 短期借贷 | 2.09 | 2.08 | 1.21 | 2.10 | 0.5% | 73.3% | -0.5% |

| 长期借贷 | 0.18 | 0.18 | 0.00 | 0.00 | 0.6% | ||

| 总负债 | 10.04 | 8.04 | 7.15 | 4.11 | 24.8% | 40.4% | 144.6% |

| 归属母公司所有者权益 | 8.80 | 8.71 | 8.34 | 7.61 | 1.1% | 5.5% | 15.6% |

| 少数股东权益 | 0.27 | 0.28 | 0.49 | 0.00 | -1.5% | -44.1% | 5418.7% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

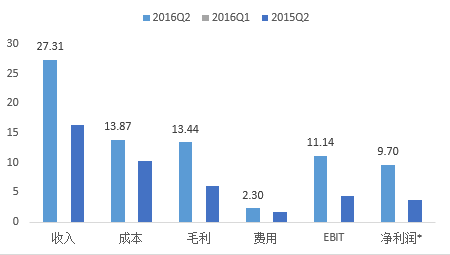

根据信义光能的中报,2016年上半年,公司实现销售收入31.75亿港元,较去年同期增长54.6%。上半年实现毛利15.52亿港元,较去年同期增长105.8%。上半年毛利率48.88%。

| 信义光能利润表(调整) | |||||

| 半年度经营成果 | |||||

| 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 27.31 | 23.76 | 16.27 | 14.9% | 67.8% |

| 成本(亿人民币) | 13.87 | 15.22 | 10.25 | -8.9% | 35.3% |

| 毛利(亿人民币) | 13.44 | 8.54 | 6.02 | 57.5% | 123.1% |

| 毛利率 | 49.21% | 35.93% | 37.03% | ||

| 费用(亿人民币) | 2.30 | 2.59 | 1.64 | -11.0% | 40.8% |

| 费用率 | 8.43% | 10.89% | 10.05% | ||

| EBIT(亿人民币) | 11.14 | 5.95 | 4.39 | 87.2% | 153.7% |

| 净利润*(亿人民币) | 9.70 | 4.91 | 3.71 | 97.6% | 161.3% |

| 标准化净利润率 | 35.51% | 20.66% | 22.81% | ||

| 归母净利润(亿人民币) | 9.54 | 5.36 | 4.74 | 77.9% | 101.2% |

| SOLARZOOM新能源智库 | |||||

单位:亿人民币

SOLARZOOM新能源智库

| 信义光能资产负债表(调整) | |||||

| 2016-6-30 | 2015-12-31 | 2015-6-30 | 半年环比 | 同比 | |

| 现金 | 15.01 | 24.03 | 8.42 | -37.5% | 78.2% |

| 应收款项 | 13.13 | 7.15 | 9.12 | 83.6% | 44.0% |

| 存货 | 1.92 | 1.67 | 3.34 | 15.3% | -42.4% |

| 总资产 | 135.12 | 106.69 | 67.31 | 26.7% | 100.8% |

| 应付账款 | 8.14 | 6.59 | 7.23 | 23.4% | 12.6% |

| 短期借贷 | 11.25 | 3.97 | 2.48 | 183.2% | 354.0% |

| 长期借贷 | 32.09 | 26.11 | 11.72 | 22.9% | 173.9% |

| 总负债 | 69.72 | 48.95 | 28.82 | 42.4% | 141.9% |

| 归母公司所有者权益 | 55.01 | 48.13 | 38.49 | 14.3% | 42.9% |

| 少数股东权益 | 10.40 | 9.60 | 0.00 | 8.3% | |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||

单位:亿人民币

SOLARZOOM新能源智库

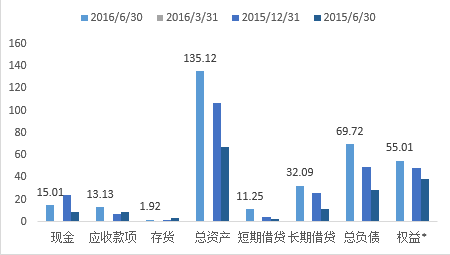

根据科士达2016半年报,报告期内,公司实现营业收入74,824.52万元,比上年同期增长19.96%,营业成本48,026.27万元,比上年同期增长了12.06%,归属于上市公司股东的净利润为11,373.04万元,比上年同期增长42.27%。基本每股收益0.26元,同比增长44.44%。光伏逆变器业务方面,实现17682万元,占总营收的23.63%,毛利率33.21%。

| 科士达利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 4.03 | 3.38 | 3.46 | 19.3% | 16.5% | 7.40 | 8.96 | 6.18 | -17.4% | 19.8% |

| 成本(亿人民币) | 2.55 | 2.25 | 2.39 | 13.1% | 6.5% | 4.80 | 5.79 | 4.29 | -17.1% | 12.1% |

| 毛利(亿人民币) | 1.48 | 1.12 | 1.06 | 31.7% | 39.0% | 2.60 | 3.17 | 1.89 | -18.1% | 37.2% |

| 毛利率 | 36.70% | 33.24% | 30.75% | 35.12% | 35.41% | 30.65% | ||||

| 费用(亿人民币) | 0.67 | 0.59 | 0.63 | 12.6% | 6.3% | 1.26 | 1.63 | 1.13 | -22.9% | 10.7% |

| 费用率 | 16.52% | 17.50% | 18.09% | 16.96% | 18.16% | 18.35% | ||||

| EBIT(亿人民币) | 0.81 | 0.53 | 0.44 | 52.9% | 85.7% | 1.34 | 1.55 | 0.76 | -13.1% | 76.8% |

| 净利润*(亿人民币) | 0.69 | 0.44 | 0.37 | 56.6% | 86.8% | 1.13 | 1.34 | 0.62 | -15.1% | 81.7% |

| 标准化净利润率 | 17.18% | 13.09% | 10.71% | 15.31% | 14.89% | 10.09% | ||||

| 归母净利润(亿人民币) | 0.65 | 0.49 | 0.46 | 32.9% | 41.5% | 1.14 | 1.53 | 0.80 | -25.9% | 42.3% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 科士达资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

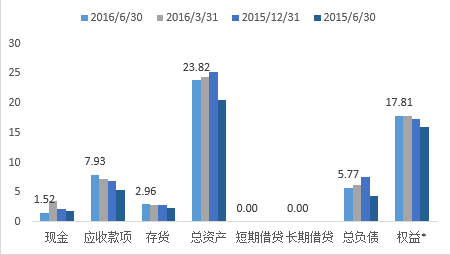

| 现金 | 1.52 | 3.56 | 2.10 | 1.76 | -57.2% | -27.5% | -13.7% |

| 应收款项 | 7.93 | 7.16 | 6.91 | 5.44 | 10.8% | 14.8% | 45.8% |

| 存货 | 2.96 | 2.91 | 2.91 | 2.35 | 1.9% | 1.8% | 26.3% |

| 总资产 | 23.82 | 24.44 | 25.25 | 20.47 | -2.5% | -5.7% | 16.4% |

| 应付账款 | 4.09 | 4.57 | 5.37 | 3.07 | -10.4% | -23.8% | 33.1% |

| 短期借贷 | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 长期借贷 | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 总负债 | 5.77 | 6.28 | 7.58 | 4.29 | -8.1% | -23.9% | 34.6% |

| 归属母公司所有者权益 | 17.81 | 17.90 | 17.40 | 15.92 | -0.5% | 2.4% | 11.9% |

| 少数股东权益 | 0.24 | 0.27 | 0.26 | 0.26 | -11.5% | -9.7% | -9.7% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

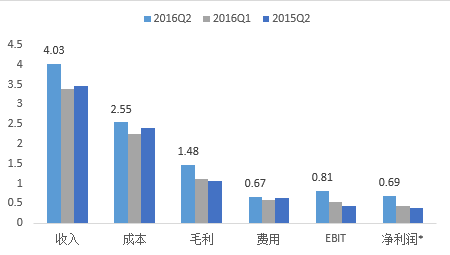

根据阳光电源2016半年报,报告期内,公司实现营业收入238,179.86万元,同比增长33.53%;实现净利润22,509.22万元,同比增长35.35%。公司主营业务为光伏逆变器和光伏电站系统集成,上半年分别实现营业收入11.69亿元和11.93亿元,毛利率分别为34.26%和14.86%。

| 阳光电源利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

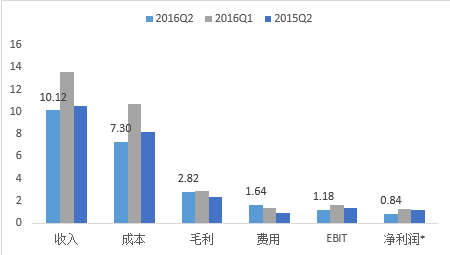

| 收入(亿人民币) | 10.12 | 13.59 | 10.51 | -25.5% | -3.6% | 23.72 | 27.74 | 17.77 | -14.5% | 33.5% |

| 成本(亿人民币) | 7.30 | 10.67 | 8.20 | -31.6% | -11.0% | 17.97 | 21.23 | 13.64 | -15.3% | 31.8% |

| 毛利(亿人民币) | 2.82 | 2.92 | 2.30 | -3.4% | 22.6% | 5.75 | 6.51 | 4.13 | -11.7% | 39.1% |

| 毛利率 | 27.89% | 21.51% | 21.92% | 24.24% | 23.47% | 23.26% | ||||

| 费用(亿人民币) | 1.64 | 1.32 | 0.93 | 24.8% | 76.5% | 2.96 | 3.07 | 1.90 | -3.5% | 56.3% |

| 费用率 | 16.24% | 9.70% | 8.87% | 12.49% | 11.07% | 10.67% | ||||

| EBIT(亿人民币) | 1.18 | 1.61 | 1.37 | -26.6% | -14.0% | 2.79 | 3.44 | 2.24 | -19.0% | 24.5% |

| 净利润*(亿人民币) | 0.84 | 1.31 | 1.22 | -35.8% | -31.1% | 2.15 | 3.12 | 1.96 | -31.2% | 9.2% |

| 标准化净利润率 | 8.28% | 9.62% | 11.59% | 9.05% | 11.24% | 11.05% | ||||

| 归母净利润(亿人民币) | 1.04 | 1.21 | 0.97 | -14.2% | 6.7% | 2.25 | 2.59 | 1.66 | -13.1% | 35.3% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 阳光电源资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

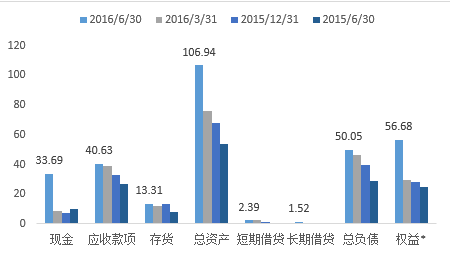

| 现金 | 33.69 | 8.71 | 7.02 | 10.03 | 287.0% | 379.6% | 235.9% |

| 应收款项 | 40.63 | 39.18 | 33.05 | 27.03 | 3.7% | 22.9% | 50.3% |

| 存货 | 13.31 | 11.70 | 13.22 | 8.19 | 13.8% | 0.7% | 62.5% |

| 总资产 | 106.94 | 76.02 | 67.83 | 53.69 | 40.7% | 57.7% | 99.2% |

| 应付账款 | 36.95 | 34.54 | 30.67 | 23.71 | 7.0% | 20.5% | 55.9% |

| 短期借贷 | 2.39 | 2.38 | 1.07 | 0.85 | 0.5% | 123.5% | 179.9% |

| 长期借贷 | 1.52 | 0.02 | 0.02 | 0.02 | 7750.5% | 6952.0% | 6619.5% |

| 总负债 | 50.05 | 46.43 | 39.47 | 28.60 | 7.8% | 26.8% | 75.0% |

| 归属母公司所有者权益 | 56.68 | 29.36 | 28.14 | 25.10 | 93.0% | 101.4% | 125.9% |

| 少数股东权益 | 0.22 | 0.23 | 0.22 | 0.00 | -6.5% | 0.1% | |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

根据易事特2016半年报,报告期内,公司实现营业收入229,073.32万元,同比增长62.02%;营业成本为195,537.13万元,同比增长67.17%;销售费用6,328.82万元,同比下降0.03%;管理费用9,265.74万元,同比增长78.66%;归属于上市公司股东的净利15,386.37万元,同比增长45.69%;扣除非经常性损益后净利润13,072.79万元,同比增长32.16%;研发投入金额为7,151.56万元,同比增长84.95%,占当期营业收入的3.12%。经营活动产生的现金流量净额31,038.75万元,同比增长236.74%。。

| 易事特利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

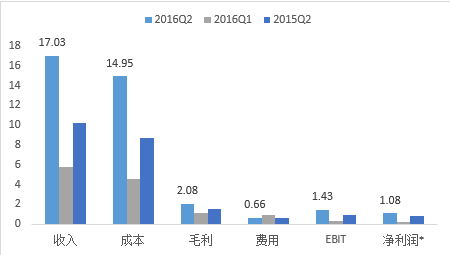

| 收入(亿人民币) | 17.03 | 5.77 | 10.23 | 195.2% | 66.5% | 22.80 | 22.61 | 14.09 | 0.8% | 61.9% |

| 成本(亿人民币) | 14.95 | 4.60 | 8.69 | 224.8% | 72.1% | 19.55 | 18.70 | 11.70 | 4.6% | 67.2% |

| 毛利(亿人民币) | 2.08 | 1.17 | 1.54 | 78.4% | 35.0% | 3.25 | 3.91 | 2.39 | -16.9% | 36.1% |

| 毛利率 | 12.23% | 20.24% | 15.08% | 14.25% | 17.30% | 16.96% | ||||

| 费用(亿人民币) | 0.66 | 0.90 | 0.62 | -27.3% | 6.3% | 1.56 | 2.08 | 1.15 | -24.9% | 35.4% |

| 费用率 | 3.85% | 15.65% | 6.04% | 6.84% | 9.18% | 8.18% | ||||

| EBIT(亿人民币) | 1.43 | 0.26 | 0.92 | 438.8% | 54.3% | 1.69 | 1.84 | 1.24 | -7.8% | 36.7% |

| 净利润*(亿人民币) | 1.08 | 0.21 | 0.79 | 410.7% | 37.8% | 1.30 | 1.71 | 1.07 | -24.0% | 21.7% |

| 标准化净利润率 | 6.37% | 3.68% | 7.69% | 5.69% | 7.54% | 7.56% | ||||

| 归母净利润(亿人民币) | 1.19 | 0.35 | 0.80 | 235.2% | 48.3% | 1.54 | 1.73 | 1.06 | -11.3% | 45.7% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 易事特资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

| 现金 | 8.18 | 6.60 | 5.24 | 3.98 | 23.9% | 56.2% | 105.5% |

| 应收款项 | 20.06 | 13.83 | 18.37 | 14.74 | 45.0% | 9.2% | 36.0% |

| 存货 | 4.09 | 6.36 | 4.98 | 3.50 | -35.7% | -17.9% | 16.9% |

| 总资产 | 52.65 | 46.42 | 44.37 | 31.77 | 13.4% | 18.7% | 65.7% |

| 应付账款 | 26.25 | 20.56 | 24.98 | 12.64 | 27.7% | 5.1% | 107.7% |

| 短期借贷 | 4.20 | 4.20 | 2.10 | 0.45 | 0.0% | 100.0% | 833.3% |

| 长期借贷 | 0.60 | 0.60 | 0.00 | 4.23 | 0.0% | -85.8% | |

| 总负债 | 38.21 | 33.22 | 30.84 | 20.10 | 15.0% | 23.9% | 90.1% |

| 归属母公司所有者权益 | 14.21 | 13.02 | 13.32 | 11.57 | 9.1% | 6.6% | 22.8% |

| 少数股东权益 | 0.23 | 0.18 | 0.21 | 0.10 | 28.4% | 9.7% | 123.4% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

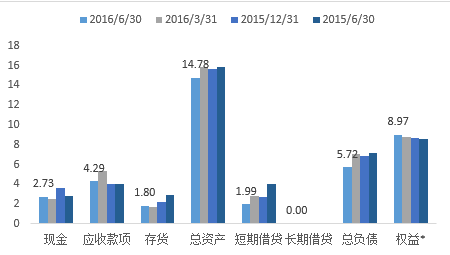

2016年上半年报告期内,公司实现收入129,948.91万元,较上年同期增长220.14%,归属母公司所有者的净利润12,228.36万元,较去年同期增长1,966.43%,主要原因系公司并表华源新能源所致。

| 珈伟股份利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

| 收入(亿人民币) | 9.30 | 4.01 | 1.71 | 132.1% | 443.8% | 13.30 | 14.89 | 4.05 | -10.6% | 228.2% |

| 成本(亿人民币) | 7.74 | 2.58 | 1.23 | 199.5% | 530.3% | 10.32 | 11.32 | 2.98 | -8.8% | 245.8% |

| 毛利(亿人民币) | 1.56 | 1.42 | 0.48 | 9.7% | 223.6% | 2.98 | 3.57 | 1.07 | -16.4% | 179.0% |

| 毛利率 | 16.78% | 35.51% | 28.21% | 22.42% | 23.98% | 26.37% | ||||

| 费用(亿人民币) | 0.51 | 0.60 | 0.50 | -14.8% | 2.7% | 1.12 | 1.19 | 1.02 | -6.5% | 9.7% |

| 费用率 | 5.52% | 15.06% | 29.27% | 8.39% | 8.02% | 25.12% | ||||

| EBIT(亿人民币) | 1.05 | 0.82 | -0.02 | 27.7% | 5873.0% | 1.87 | 2.38 | 0.05 | -21.4% | 3573.1% |

| 净利润*(亿人民币) | 0.46 | 0.77 | -0.11 | -39.6% | 511.8% | 1.23 | 1.65 | -0.06 | -25.6% | 2195.6% |

| 标准化净利润率 | 4.97% | 19.11% | -6.57% | 9.23% | 11.08% | -1.45% | ||||

| 归母净利润(亿人民币) | 0.76 | 0.46 | -0.11 | 63.7% | 787.6% | 1.22 | 1.43 | -0.07 | -14.8% | 1966.4% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 珈伟股份资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

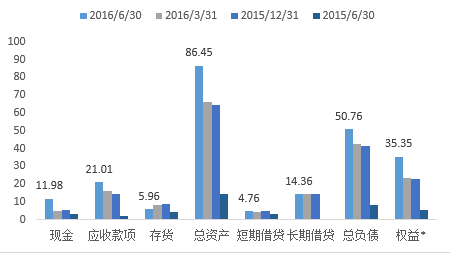

| 现金 | 11.98 | 4.77 | 5.39 | 3.10 | 151.0% | 122.4% | 286.8% |

| 应收款项 | 21.01 | 15.98 | 14.63 | 2.03 | 31.4% | 43.6% | 933.9% |

| 存货 | 5.96 | 8.47 | 8.68 | 4.48 | -29.6% | -31.3% | 33.0% |

| 总资产 | 86.45 | 66.47 | 64.77 | 14.29 | 30.1% | 33.5% | 504.8% |

| 应付账款 | 12.03 | 11.65 | 13.72 | 3.01 | 3.3% | -12.3% | 300.3% |

| 短期借贷 | 4.76 | 4.55 | 4.75 | 3.40 | 4.4% | 0.1% | 39.7% |

| 长期借贷 | 14.36 | 14.39 | 14.42 | 0.48 | -0.2% | -0.4% | 2870.6% |

| 总负债 | 50.76 | 42.55 | 41.23 | 8.24 | 19.3% | 23.1% | 516.4% |

| 归属母公司所有者权益 | 35.35 | 23.58 | 23.20 | 5.81 | 49.9% | 52.4% | 508.6% |

| 少数股东权益 | 0.34 | 0.33 | 0.34 | 0.25 | 1.6% | 0.8% | 35.4% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

根据航天机电公布的2016年半年报,报告期,公司实现营业收入24.07亿元,同比增长74.22%;实现归属于上市公司股东的净利润为9,637.22万元,与上年同期相比,大幅增加,实现扭亏为盈。报告期内,公司光伏组件销量442MW,同比增长84%,其中国内市场实现销售345MW,海外市场实现销售97MW。公司上半年仅新增分布式光伏电站建设指标/备案5.76MW,新开工建设电站项目11MW,并网投运66MW。电站运维业务方面,上航电力电站运维已超1GW,其中600MW为外部运维业务。

| 航天机电利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

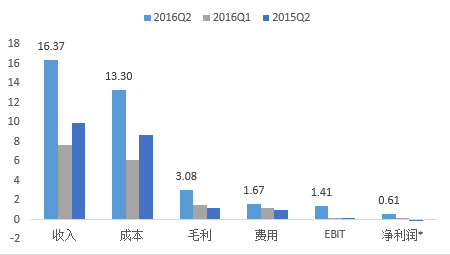

| 收入(亿人民币) | 16.37 | 7.62 | 9.86 | 114.9% | 66.0% | 23.99 | 26.70 | 13.48 | -10.1% | 78.1% |

| 成本(亿人民币) | 13.30 | 6.15 | 8.69 | 116.1% | 52.9% | 19.45 | 21.72 | 11.84 | -10.5% | 64.2% |

| 毛利(亿人民币) | 3.08 | 1.47 | 1.17 | 109.9% | 163.5% | 4.54 | 4.98 | 1.63 | -8.7% | 178.5% |

| 毛利率 | 18.80% | 19.25% | 11.85% | 18.94% | 18.65% | 12.11% | ||||

| 费用(亿人民币) | 1.67 | 1.24 | 1.03 | 34.0% | 61.1% | 2.91 | 3.10 | 1.94 | -6.2% | 49.5% |

| 费用率 | 10.17% | 16.31% | 10.48% | 12.12% | 11.62% | 14.43% | ||||

| EBIT(亿人民币) | 1.41 | 0.22 | 0.13 | 531.4% | 948.4% | 1.64 | 1.88 | -0.31 | -12.8% | 623.6% |

| 净利润*(亿人民币) | 0.61 | 0.18 | -0.15 | 229.1% | 497.4% | 0.79 | 0.86 | -0.45 | -8.2% | 274.7% |

| 标准化净利润率 | 3.71% | 2.42% | -1.55% | 3.30% | 3.23% | -3.36% | ||||

| 归母净利润(亿人民币) | 0.50 | 0.46 | 0.68 | 7.9% | -26.7% | 0.96 | 1.91 | -0.18 | -49.5% | 634.4% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 航天机电资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

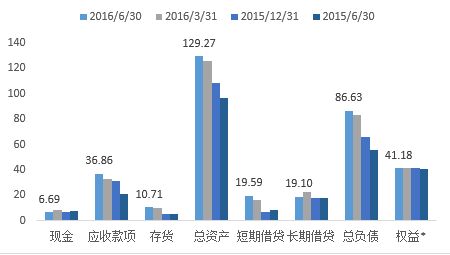

| 现金 | 6.69 | 8.62 | 6.99 | 7.45 | -22.4% | -4.4% | -10.2% |

| 应收款项 | 36.86 | 32.82 | 31.66 | 20.89 | 12.3% | 16.4% | 76.4% |

| 存货 | 10.71 | 10.47 | 5.63 | 5.48 | 2.3% | 90.3% | 95.5% |

| 总资产 | 129.27 | 125.99 | 108.00 | 96.35 | 2.6% | 19.7% | 34.2% |

| 应付账款 | 41.84 | 43.67 | 37.86 | 29.44 | -4.2% | 10.5% | 42.1% |

| 短期借贷 | 19.59 | 16.10 | 7.20 | 8.36 | 21.7% | 172.0% | 134.3% |

| 长期借贷 | 19.10 | 22.67 | 18.27 | 17.80 | -15.7% | 4.6% | 7.3% |

| 总负债 | 86.63 | 83.05 | 66.12 | 55.39 | 4.3% | 31.0% | 56.4% |

| 归属母公司所有者权益 | 41.18 | 41.44 | 41.25 | 40.51 | -0.6% | -0.2% | 1.7% |

| 少数股东权益 | 1.46 | 1.49 | 0.63 | 0.45 | -2.4% | 132.4% | 224.9% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

2016年上半年实现营业收入213,237.91万元,同比增长33.17%,但受电站板块送出线路检修及限电等因素影响,归属于上市公司股东净利润22,038.33万元,同比下降12.97 %。按照板块划分,公司电站板块2016年上半年销售电力85,956.89万度,同比增加10.67%;实现营业收入74,277.63万元,同比增加2.40%。太阳能产品板块2015年上半年实现组件销售363兆瓦,同比增加73.68%,实现营业收入138,345.59万元,同比增加58.65%

| 太阳能利润表(调整) | ||||||||||

| 季度经营成果 | 半年度经营成果 | |||||||||

| 2016Q2 | 2016Q1 | 2015Q2 | 环比 | 同比 | 2016H1 | 2015H2 | 2015H1 | 环比 | 同比 | |

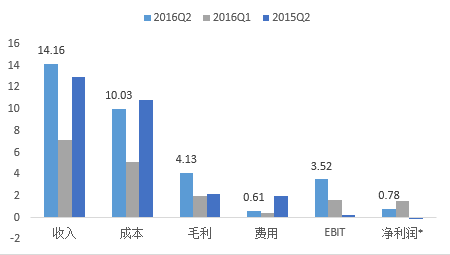

| 收入(亿人民币) | 14.16 | 7.13 | 12.99 | 98.7% | 9.0% | 21.28 | 10.85 | 25.28 | 96.2% | -15.8% |

| 成本(亿人民币) | 10.03 | 5.10 | 10.79 | 96.7% | -7.1% | 15.13 | 2.50 | 21.30 | 504.7% | -29.0% |

| 毛利(亿人民币) | 4.13 | 2.03 | 2.19 | 103.8% | 88.2% | 6.16 | 8.35 | 3.99 | -26.3% | 54.4% |

| 毛利率 | 29.17% | 28.44% | 16.89% | 28.92% | 76.94% | 15.77% | ||||

| 费用(亿人民币) | 0.61 | 0.42 | 1.99 | 45.0% | -69.3% | 1.04 | -1.33 | 3.60 | 177.7% | -71.2% |

| 费用率 | 4.33% | 5.94% | 15.36% | 4.87% | -12.30% | 14.24% | ||||

| EBIT(亿人民币) | 3.52 | 1.60 | 0.20 | 119.3% | 1665.6% | 5.12 | 9.68 | 0.39 | -47.1% | 1224.2% |

| 净利润*(亿人民币) | 0.78 | 1.55 | -0.06 | -49.3% | 1372.3% | 2.33 | 4.64 | 0.12 | -49.7% | 1919.8% |

| 标准化净利润率 | 5.54% | 21.73% | -0.48% | 10.96% | 42.78% | 0.46% | ||||

| 归母净利润(亿人民币) | 1.91 | 0.29 | 0.09 | 561.4% | 2099.1% | 2.20 | 4.54 | 0.19 | -51.4% | 1059.6% |

| SOLARZOOM新能源智库 | ||||||||||

单位:亿人民币

SOLARZOOM新能源智库

| 太阳能资产负债表(调整) | |||||||

| 2016-6-30 | 2016-3-31 | 2015-12-31 | 2015-6-30 | 季度环比 | 半年环比 | 同比 | |

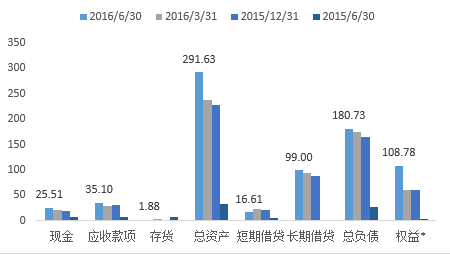

| 现金 | 25.51 | 20.52 | 18.65 | 7.31 | 24.3% | 36.8% | 248.8% |

| 应收款项 | 35.10 | 29.41 | 30.44 | 7.30 | 19.3% | 15.3% | 380.7% |

| 存货 | 1.88 | 2.77 | 1.25 | 6.65 | -32.1% | 50.3% | -71.7% |

| 总资产 | 291.63 | 237.34 | 227.37 | 32.83 | 22.9% | 28.3% | 788.3% |

| 应付账款 | 39.19 | 31.15 | 29.64 | 16.62 | 25.8% | 32.2% | 135.8% |

| 短期借贷 | 16.61 | 23.80 | 21.80 | 6.00 | -30.2% | -23.8% | 176.9% |

| 长期借贷 | 99.00 | 93.80 | 87.56 | 0.27 | 5.5% | 13.1% | 36567.1% |

| 总负债 | 180.73 | 175.22 | 165.19 | 27.98 | 3.1% | 9.4% | 546.0% |

| 归属母公司所有者权益 | 108.78 | 60.10 | 60.22 | 4.16 | 81.0% | 80.7% | 2515.0% |

| 少数股东权益 | 2.11 | 2.01 | 1.97 | 0.69 | 4.8% | 7.2% | 205.2% |

| 单位:亿人民币 | SOLARZOOM新能源智库 | ||||||

单位:亿人民币

SOLARZOOM新能源智库

Solarzoom光伏亿家出品

本期责编:Alex

联系方式:alex.ding@solarzoom.com